The European Commision´s proposal to reform electricity markets

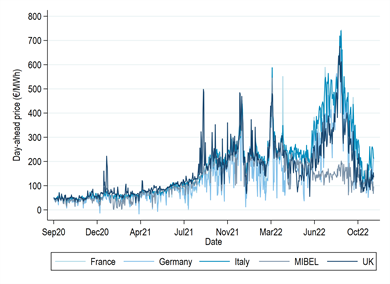

Europe has faced – and still faces – an unprecedented energy crisis that has translated into record-high gas and electricity prices (Figure 1). These prices have further propagated throughout the European economy, as evidenced by the spike in inflation and core inflation in Europe (Verwey and Dieckmann 2023). In response to the energy crisis, which was particularly severe during the summer of 2022, Ursula von der Leyen announced that the European Commission would work on “a deep and comprehensive reform of the electricity market” (for a discussion of the announcement at the time, see Fabra 2022). Almost half a year later, the Commission is about to disclose its proposed reform. However, some public statements (for example, by the European Commission Director of Green Transition and Energy System Integration at the European Parliament on 7 March) and leaks of the proposal allow for a preliminary assessment of the (supposedly) key elements of the reform.

Figure 1 Evolution of wholesale gas and electricity prices in Europe

(a) Wholesale electricity prices

(b) Wholesale gas prices

Sources: Red Eléctrica; MIBGAS, investing.com

In this column, we summarise the key elements of the European Commission’s leaked proposal through the lens of our submission to the public consultation that was launched by the Commission in preparation for the reform. Our submission, jointly co-authored by a group of European economists, is now available as a CEPR Policy Insight (Ambec et al. 2023).

The European Commission’s proposal for an electricity market reform

The primary goal of the Commission’s proposed electricity market reform is to reduce the price volatility faced by electricity consumers and investors – surprisingly, the goal of achieving competitive prices only appears as a byproduct. To achieve stable prices, the Commission proposes preserving short-run electricity markets while promoting private bilateral mechanisms for long-term contracting and fixed-price retail contracts under the condition that energy suppliers are sufficiently hedged. And in case of emergencies, the Commission proposes to decouple electricity bills from short-run prices by capping the retail price for a fixed volume of energy – yet the Commission does not clarify who will pay for the difference.

Agreements…

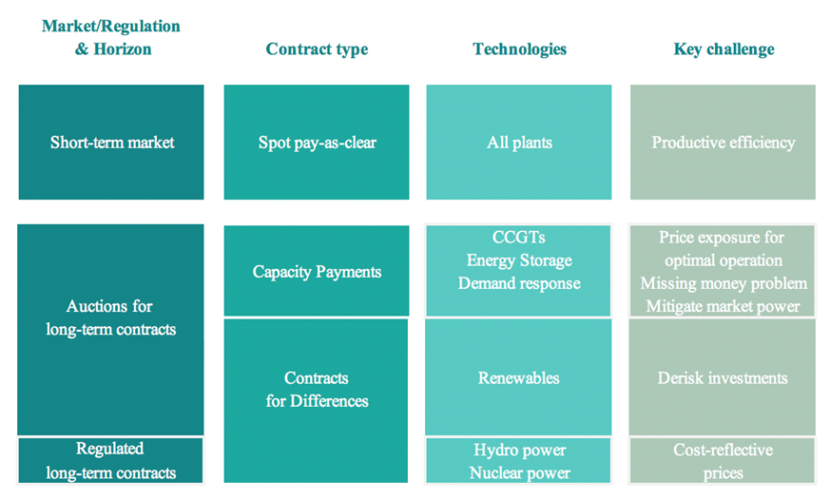

Our views coincide with the Commission’s proposal in some respects but depart from it in other fundamental ways. In our submission, and in line with the Commission’s proposal, we advocated for preserving short-run electricity markets, which are instrumental in achieving productive efficiency and guiding efficient consumption decisions. However, we also argued that reliance on short-run markets alone is inadequate as their prices are overly volatile, do not reflect the average costs of the various generation technologies, and fail to provide efficient market signals for long-run investments on the supply side (e.g. investments in renewable energies) and on the demand side (e.g. investments in electrification by industry). It is important to keep in mind that the objective should not only be to decarbonise the power sector but the economy as a whole. However, without competitive and stable electricity price levels, the industry will be discouraged from electrifying its production process, which is the most effective tool for carbon abatement. Therefore, we believe that a pillar of electricity market design should be the development of healthy long-run contracting arrangements capable of addressing those concerns.

… and disagreements

However, our proposal differs from the Commission’s on the best mechanisms to achieve sufficient and competitive long-term contracting. In particular, we are sceptical of the Commission’s emphasis on private bilateral contracting through so-called power purchase agreements (PPAs). While PPAs have allowed for a first round of investments, it is unlikely that they will deliver the scale of renewable energy investments at the speed needed to achieve the energy security and climate objectives agreed upon at the EU and Member State levels.

One of the key reasons is that PPAs are subject to large counterparty risks, given that the off-takers will have strong incentives to renege from these contracts once the short-run electricity market prices fall, as is expected (Figure 2). In order to mitigate these risks and promote the PPA market, the Commission proposes that Member States provide public guarantee schemes through state aid. In our submission, we warned against this policy as it will put large amounts of public money at risk while giving rise to moral hazard problems and gaming opportunities on the side of the off-takers. Equally worrying is a proposal for a minimum share of PPAs to be signed by retail companies, which would make their demand for PPAS price-inelastic, further strengthening the bargaining power of the generators. As argued below, regulatory-defined purchases should be implemented through transparent procurement processes and products, for example through public tenders.

Figure 2 Evolution of futures electricity prices in Spain, France, and Germany

Source: OMIP

Furthermore, we are concerned about the competitive implications of PPAs. Markets for PPAs are not frictionless or transparent, which contributes to weakening competition and raising barriers to entry for new players. Furthermore, electricity generators commonly stand at stronger bargaining positions vis-à-vis the buyers, giving rise to prices that exceed the generation costs while providing an inadequate hedge for the buyers’ consumption profiles. This is particularly worrisome in the case of smaller actors, for whom reliance on PPAs puts them in a disadvantaged position relative to the larger players. Furthermore, when energy retailers sign PPAs, there is no guarantee that PPA prices will be passed on to the final end-users – a concern that is founded on the evidence of weak competitive pressure in retail energy markets.

A boost for regulatory-backed auctions for long-term contracts

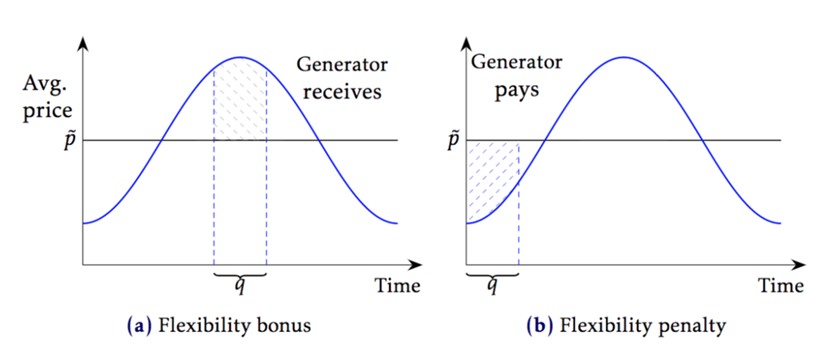

Instead, we propose to boost the use of regulatory-backed auctions of long-term contracts for differences (CfDs). We argued that only this tool could ensure a sufficient scale of long-term contracts to offer a credible investment perspective for the required volumes of renewable energy projects. In turn, this is essential to unlocking the investments into an EU supply chain of renewable energies’ manufacturing capacity. A CfD model has already been successfully implemented in various EU countries, achieving significant reductions in financing costs for project developers, thus allowing energy consumers to reap large reductions in the price of renewables.

CfDs can be pooled and then passed on to final consumers (or retail companies on their behalf) in ways that do not distort the short-run price signals or retail competition. Thus, consumers are hedged against wholesale price volatility while benefiting from attractive renewable prices. Consumers, or retailers on their behalf, are thus encouraged to hedge the gap between the renewable production and their demand profiles, thus unlocking flexibility and catalysing suitable forward markets.

Despite all the benefits and opportunities that CfDs offer European consumers, the leaked Commission proposal views CfDs almost as a tool of last resort. The prevalence of PPAs over CfDs advocated by the Commission is so strong that they even propose to distort these auctions for CfDs by giving preference to bidders that have signed a PPA for part of the project’s generation. This can have adverse consequences on the auction performance and the relative efficiency of the winning projects. It is nevertheless positive that the Commission advocates for the use of two-way CfDs, which hedge both producers and consumers, instead of one-way CfDs, which only protect the former.

Limiting the excessive profits of inframarginal generators

Last, we also depart from the European Commission proposal in its decision to phase out measures to limit the revenues of the existing inframarginal generators (nuclear, hydro, and renewables), i.e. the possibility to limit the revenues of these technologies at a maximum of €180/MWh. This decision is surprising: the text reckons these plants have consistently made record-high profits, given that their costs (Figure 3) are well below the prices negotiated in the short-run electricity markets (Figure 1). However, the Commission’s proposal does not comprise any option to stop this from repeating itself at the expense of European consumers.

On the contrary, in our Policy Insight we argue in favour of maintaining a mechanism to address such windfall profits as a coordination success among Member States in moments of critical tension. Given the possibility that the market will experience extreme conditions in the future, and the challenges experienced will repeat, it is best to retain a pre-defined safety valve that will partly avoid the turmoil observed during the energy crisis, during which governments had to make quick decisions to limit the burden of energy costs to businesses and households while assuming substantial debt. Furthermore, we see no compelling reason why legacy technologies, such as large hydro projects and nuclear plants built prior to liberalisation under regulatory-backed risk-free decisions, should be allowed to reap windfall profits while causing huge societal costs.

Figure 3 Average costs of electricity generation

Source: International Energy Agency (projected costs for 2020)

Conclusions

We believe that Europe’s industry and households cannot afford to pay high and volatile electricity prices much longer, and we remain sceptical as to whether the European Commission’s proposal will do much to address these concerns. The proposal does not mitigate the risk that episodes of sustained high prices, like those seen during the summer and autumn of 2022, might repeat during 2023/2024. Nor does the proposal offer a much-needed perspective to industry and households on how they can benefit from the cost reductions of renewable energy technologies. Limiting the electricity reform to cosmetics would be a lost opportunity to tame the fears of European deindustrialisation while pushing the European ambition in the green battle.

After all, it does not seem that the Commission’s proposal will be as deep and comprehensive as Ursula von der Leyen had initially announced – unless the European Parliament and the Council do something to avoid the plus ca change, plus c’est la meme chose…