ELECTRIC CHALLENGES

ELECTRIC CHALLENGES is an ERC Consolidator grant funded project led by Natalia Fabra at Universidad Carlos III de Madrid. Its main objective is to analyze regulatory and market-based solutions aimed at achieving the energy transition at least cost.

The fight against climate change is among Europe’s main policy priorities. In this project, we propose to push out the frontier in the area of Energy and Environmental Economics by carrying out policy-relevant research on the design of optimal regulatory and market-based solutions to achieve the low-carbon transition at least cost.

The European experience provides unique natural experiments with which to test some of the most contentious issues that arise in the context of electricity markets. These include the potential to change households’ demand patterns through dynamic pricing, the scope for renewables to mitigate market power and depress wholesale market prices, and the design and performance of the auctions for renewable support. The objective is to shed light on such policy issues through the lens of state-of-the-art methodologies.

We rely on cutting-edge theoretical, empirical, and simulation tools to disentangle these topics, while at the same time providing key economic insights that are relevant beyond electricity markets.

The conclusions of this research should prove valuable for academics, as well as to policy makers to assess the impact of environmental and energy policies and redefine them where necessary.

The research team is composed of a group of first-class economists and PhD students. The output of the project will be regularly released through seminars and publications.

ENERGEIA SIMULA

ENERGEIA SIMULA is a windows-based simulation tool that computes equilibrium outcomes in electricity wholesale markets.

The simulations performed by energeia simula are based on an oligopoly model that reflects most important features of electricity markets. This model has been published in a leading journal in economics:

De Frutos, M.A. and Fabra, N. (2012), “How to Allocate Forward Contracts: the case of electricity markets” European Economic Review 56(3), 451-469.

Fabra, N., Lacuesta A. and Souza, M. (2022), “The implicit cost of carbon abatement during the COVID-19 pandemic” European Economic Review, forthcoming.

Energeia simula is capable of predicting (static) equilibrium bidding behavior among generators under various scenarios.

It allows to assessing the effects of (among others):

- Changes in market structure: mergers, divestitures, plant closures, investment in new technologies, entry of new firms, etc.

- Changes in input costs: gas, coal and CO2 prices

- Changes in market rules: contract obligations, emissions regulation, etc.

A sample of analyses performed with Energeia can be found here.

STORAGE IN ELECTRICITY MARKETS

Storage in Electricity Markets: Investment Incentives and Regulation is a one-year research project funded by Fundación Iberdrola. Its main objective is to analyze the use of and the investment in storage facilities in electricity markets, and how it depends on market structure in the generation and storage segments.

The energy transition requires a massive deployment of renewable energies in the electricity sector. Driven by the reduction in their investment costs, the expansion of renewables will accelerate during the next two decades. However, it will not be possible to completely eliminate fossil fuels from electricity generation until storage solutions are developed to cope with the intermittency of renewable energies. For this reason, it is essential to understand whether the current market and regulatory arrangements provide the right incentives for the optimal use and investment in storage facilities. In this project we will address this central issue, both through theoretical modeling as well as through an empirical analysis in the context of the Spanish electricity market. In addition, we will explore regulatory alternatives that would be suitable to align private and social incentives for the use and investment in storage.

Fabra, N. and Andrés-Cerezo, A. (2023), “Storing Power: Markets Structure Matters“, RAND Journal of Economics. Volume 54 (1), 3-53.

Fabra, N. and Andrés-Cerezo, A. “Renewable energy and storage: friends or foes?“

URBAN SKIES

“The Socio-Economic Impacts of Low Emission Zones (LEZs)” is a two-years research project funded by Fundación La Caixa. The project will contribute to the debate regarding two global questions of key socio-economic relevance: the design of environmental policies and the future of cities.

LEZs are areas where access to part of a city is restricted to discourage polluting types of vehicles from entering the area. This regulation has been increasingly popular given that half of the EU countries adopted this policy to address pollution from road transport. The health, economic, and societal costs of local air pollution are substantial, ranging from decreased life expectancy and increased infant mortality to far-reaching economic implications such as job losses or decreased consumer spending.

The project aims to provide rigorous evidence-based policy on the effectiveness of Low Emission Zones in Madrid and Barcelona. This will include (1) investigating whether LEZs are powerful enough to shift the car fleet composition towards cleaner cars, (2) documenting the shift of habits towards shared-mobility options, and (3) estimating its impact on the economic activity within the restricted areas. Access to high-frequency and hyper-local data (including car registration data, car, and bike-sharing data, and card transactions data, together with socio-demographics) will allow rigorous empirical analysis on these issues. The results will provide valuable evidence on the best courses of action to address environmental challenges in many cities across the world, including many European cities that will soon have to implement similar urban access regulations.

Fabra, N., C. Pintassilgo, and M. Souza, “Observed Patters of Use and Users of Free-Floating Car-Sharing”

Fabra, N., E. J. Muehlegger, and M. Souza, “The Welfare Effects of Car Sharing”

GREEN AND DIGITAL FINANCE

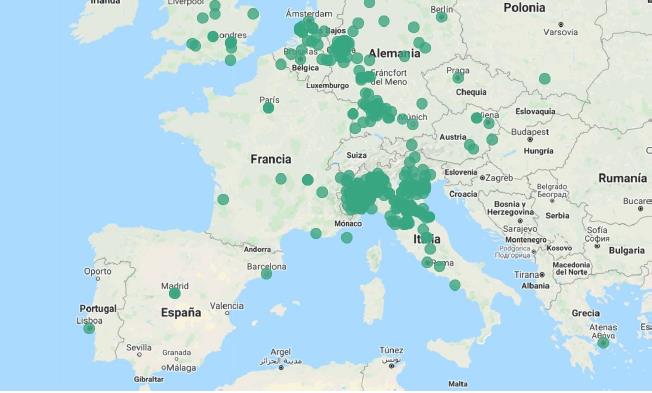

Climate risk has emerged as an increasingly critical issue within the realm of economic activity. Policymakers, business leaders, and other prominent figures have expressed growing concerns about the potential economic impacts of climate change on various sectors. Recognizing the urgency of addressing this issue, significant efforts have been made to integrate climate risk into policy frameworks and decision-making processes. In a notable development, in 2022, the European Central Bank (ECB) conducted a stress test for banks, with a primary focus on assessing their resilience to climate-related risks. This initiative by the ECB underscores the recognition of climate risk as a systemic threat that must be taken into account in financial stability assessments and further highlights the imperative for proactive measures to mitigate and adapt to the potential consequences of climate change.

EnergyEcoLab has partnered with Arfima Financial Solutions and Universidad Nacional de Educación a Distancia to carry out the project GREEN AND DIGITAL FINANCE, which is funded by the Spanish Recovery Plan (NextGen EU). The consortium also collaborates with external partners, notably the OS-Climate Community. The goal of our project is to create a platform that will assist banks in assessing climate risk. By leveraging advanced data collection methods from diverse sources and implementing sophisticated analytical techniques, the platform will provide banks with comprehensive insights into climate-related risks.