December 2022

Toward a new electricity market model: is decoupling the right approach?

The energy crisis that was triggered by the Russian war in Ukraine has led European power markets to unprecedented levels of prices and stress. It has also led to wide ranging policy interventions and calls for reforms of the wholesale electricity market design.

Whilst the market failures or missing markets that affect electricity markets have been covered in great depth in the economic literature, the historic target model defined in 1980s has remained the basis for Europe’s liberalisation and integration of power markets in the past two decades.

The ongoing energy crisis in Europe has revived the debate on the issues with the current market design based on the marginal cost approach. The policy momentum for a reform of electricity markets seems to be building up as the European Commission announced that it will put forward some proposals in the first part of 2023.

“Decoupling” seems to have become the buzz word in European policy debates. However, there seems to be a lot of confusion on the type and scope of the decoupling. In some cases, decoupling refers to the reduction of European’s dependence on gas imports and the link between international gas markets prices and electricity prices. In other cases, the focus is on the decoupling of price formation in wholesale markets, by splitting the market between dependable and not dependable technologies. Other proposals focus on the policy objective of decoupling end user prices from the wholesale price signals, whilst leaving the wholesale market operating as it does today.

In this context, Université Paris Dauphine-PSL organized the CEEM Conference (Chair European Electricity Markets) with the aim to present and discuss the different proposals for alternative market models that have been put forward by scholars and experts.

Natalia Fabra participated speaking about new electricity market architecture.

See Natalia´s presentation here.

See the program here.

Electricity Markets in Transition: A proposal for reforming European electricity markets

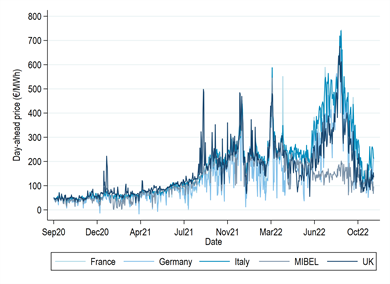

“The current electricity market design is not doing justice to consumers anymore. They should reap the benefits of low-cost renewables. So, we have to decouple the dominant influence of gas on the price of electricity. This is why we will do a deep and comprehensive reform of the electricity market.” These words were pronounced by the President of the European Commission in her State of the European Union speech in September 2022 (von der Leyen, 2022). By then, gas and electricity prices had reached record highs (Figure 1), with growing concerns about gas shortages during winter (Martin & Weder di Mauro, 2022). The rise in energy costs contributed to double-digit inflation in the Euro area (Eurostat, 2022), leading to the highest-ever increase in interest rates by the European Central Bank (Dieppe & Brignone, 2022).

Four months later, the European Commission is about to open a public consultation on the electricity market reform they are working on (European Commission, 2022). In this column, I shed light on what I think should be the building blocks of this reform. The interested reader can find the full details of the proposed electricity market architecture in Fabra (2022).

Figure 1: Electricity prices in European wholesale electricity markets

Source: Red Eléctrica de España.

Objectives and Building Blocks of the New Market Architecture

The reform should lead to efficient and equitable electricity market outcomes. In the short run, achieving productive efficiency requires that demand is met, at every moment in time, by the plants with the lowest marginal costs. In the long run, investments should efficiently take place at the right scale and locations. In particular, investments in low-carbon technologies should be promoted to meet future electricity needs without compromising security of supply. For equity, households and businesses should fully benefit from the lower costs of these technologies, which further helps promote electrification to decarbonize hard-to-abate emissions in other sectors.

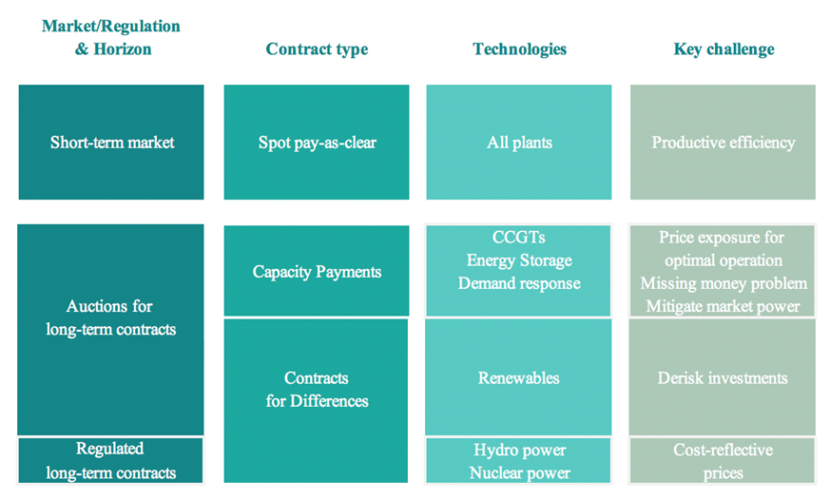

Figure 2: The proposed market architecture

These objectives can be reconciled by combining short-term energy markets— which provide short-run signals for efficient generation and consumption—with long-term contracts—which facilitate efficient investments in generation while adjusting their profitability through competitive forces (Figure 2). These two pillars of the proposed electricity market architecture complement each other and interact in several ways. In more detail:

- A well-functioning short-term market:

Electricity demand and supply change at high frequency. Hence, productive efficiency must rely on electricity markets that clear close to real-time, very similar to those operating today in Europe. However, certain design elements can be put forward to improve their performance. Importantly, compulsory participation in these markets (as in the original UK market design) would contribute toward greater liquidity and transparency without preventing the market participants from entering into financial contracts with third parties. Long-term contracts, as described below, would further prevent the short-run price signal from being distorted by market power (Fabra and Imelda, 2022).

- Efficient and equitable long-term contracts for all consumers:

Electricity generation assets are highly capital-intensive and long-lived, often giving rise to various positive and negative externalities (e.g., affecting learning economies, security of supply, or the environment, to name just a few). This suggests that achieving long-term efficiency requires some form of long-term contracting, with the regulator playing an active role in deciding the investments’ scale and technologies. Furthermore, for outcomes to be equitable, regulators must resort to mechanisms allowing electricity prices to reflect the average costs of the investments in ways compatible with facing firms and consumers to short-run prices. In my view, adequate long-term contracting is missing from current electricity markets, and addressing this should be the focus of our efforts. How exactly should long-run contracts be incorporated into the market architecture?

Designing Long-term Contracts

In line with other economists (see Newbery 2022, Roques and Finon, 2002, Kröger et al., 2022, among others), I advocate for developing a system of long-term contracts between the regulator and the generators. Reliance on long-term contracts allows derisking the investments, effectively allowing for an efficient transfer of risk—from the more risk-averse side (i.e., the private investors) to the less risk-averse side (i.e., the regulator on behalf of all consumers). This approach facilitates generators’ access to cheaper capital, opening the market to competitors that would otherwise not be able to finance the investments. Competition for these contracts through auctions organized by the regulator would pass on this efficiency gain to consumers, who would also be hedged against excessive price volatility.

The design of long-term contracts should differ across technologies depending on their flexibility to respond to short-run price signals. These contracts can be designed so as to enhance firms’ efficient behavior in the short-term market. For instance, preserving full-price exposure is paramount for the efficient operation of storable resources, including hydropower, which should be used when they are most valuable. On the contrary, exposing wind or solar plants to short-run prices brings limited benefits, given that their output is intermittent and exogenously given by weather conditions.

An important economic principle should be kept in mind throughout: exposing producers to short-run price signals is compatible with decoupling their average payments from those prices. To see this, consider the design of contracts-for-differences (CfDs). Under these contracts, producers sell their output in the short-term market and then pay/receive the difference between a ‘reference price’ and the contract’s strike price. Setting the ‘reference price’ equal to the short-term price is equivalent to a fixed price contract with no price exposure and no price risk. Departing from this allows for striking the right balance between the benefits of price exposure and the costs of increasing investors’ risks, a trade-off that depends on the technologies’ characteristics.

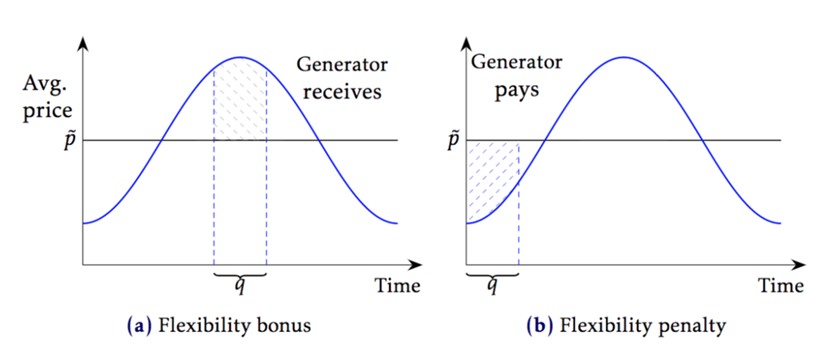

For instance, for hydropower plants, setting the ‘reference price’ at the annual average market price effectively provides a bonus for producing at peak times or a penalty for producing at off-peak times (Figure 3). For intermittent renewables, setting the ‘reference price’ at the monthly average price captured by plants of the same technology incentivizes them to locate at sites where the availability of solar irradiation or wind is positively correlated with market prices, contributing to reducing the system’s costs. In both cases, marginal incentives are preserved while their profitability is adjusted through the choice of the strike price. Setting the strike price through auctions before the investments have been made contributes to achieving cost-reflective electricity prices.

Figure 3: Flexibility bonus/penalty implicit in the contracts for differences for hydropower plants

However, sufficient participation in the auction is needed for competitive forces to deliver a fair rate of return. Incentivizing firms to participate in the auction requires that the outside option of selling directly to the short-term market is not feasible or not too attractive. Once renewables are massively deployed, the short-term market prices captured by renewables will converge towards their (almost zero) marginal costs, i.e., below their average costs. Hence, entry outside the auction will not be attractive even if feasible. Until then, participation in the auction could be promoted by limiting (at a reasonable level) the maximum price that renewables can obtain in short-term markets – not just as a crisis instrument but as a permanent market feature. Since renewables have low marginal costs, such a cap would not distort their efficient operation.

For existing plants, competition to enter the market is simply not possible. Two options to guarantee equitable outcomes are to introduce technology-specific caps or to regulate their strike prices in a cost-reflective manner. No doubt, this will require political will. However, the economic, social, and political costs of not addressing the large windfalls made by these plants are not less challenging.

Last, the characteristics of gas plants, storage, and demand response facilities suggest they should be fully exposed to short-term market prices. Yet, to overcome their missing money problem (Joskow, 2008) – in essence, short-term market prices do not allow them to recover their investment costs – they should receive capacity payments – not necessarily technology-neutral as they are nowadays (Fabra and Montero, 2022). In the case of gas plants, capacity payments should be combined with commodity-indexed price caps (the so-called reliability options) to prevent them from exercising market power when they are pivotal.

Contracting with the regulator, or bilaterally?

One recurring question in the debate is whether regulators should be the counterparty of the long-term contracts or whether such contracts should be freely signed bilaterally between generators and retailers (the so-called PPAs), with no public intervention. My view is that the latter are not substitutes for the former. We have seen this already: nothing prevents PPAs from being signed, yet several market failures have led to scarce and excessively short PPA contracting (May et al., 2022). Furthermore, even if large energy retailers manage to secure low wholesale prices through PPAs, imperfect competition in the retail market often implies that such prices are not passed on to the final consumers. In contrast, regulators can commit for sufficiently long periods compatible with the recovery of the investments. This would substantially reduce counterparty risk, which is instrumental in lowering the costs of procuring renewable energy (Ryan, 202). Furthermore, a system of regulator-backed long-term contracts would guarantee that all consumers – regardless of their bargaining powers – would benefit equally from the reduced counterparty risk and the enhanced bargaining power of the regulator acting as a large buyer.

Last, even if desirable, increasing the liquidity of forward markets is not a substitute for these regulator-backed long-term contracts either. The prices of forward contracts tend to converge to the expected short-term market prices over the same period, thus reducing price volatility but not the price level.

Conclusions

Europe must take advantage of this opportunity to redesign an outdated electricity market design, which threatens the region’s economic, social and environmental objectives. Changing the electricity market design without significantly affecting the outcomes would be a lost opportunity. The risk of Plus ça change, plus c’est la même chose…is not negligible. In my proposal, I argue that it is feasible to redesign electricity markets to make them more robust to the current and future energy crises while simultaneously achieving carbon abatement goals at least cost for consumers and society. Power markets can be a powerful source of welfare for the whole economy, just as long as we design them right.

We are Hiring! Vacancy for Postdoctoral Research Fellowship in Economics

We are recruiting one Postdoctoral Researcher with a PhD in Economics or Finance.

The candidate should have an outstanding commitment to research, as well as prior research experience in the areas of Energy and Environmental Economics and/or Empirical Industrial Organization. The position can be filled for one to two years, starting September 2023.

The Economics Department at Universidad Carlos III de Madrid has strong international ties, a widely recognized graduate school, and has been awarded special support as a Center of Excellence by the Spanish government.

Duties: successful candidates are expected to

• contribute to the activities of the research group in the form of research assistance and joint research comparable to a standard teaching load

• participate in the activities of the research group (seminars, workshops, lunch meetings)

• further their own research agenda in the area of energy and environmental economics and sustainable finance

• no teaching duties involved

Requirements: applicants should

• hold a PhD in Economics or Finance (or be close to completing it) from a highly-ranked university

• have excellent qualifications, as well as outstanding own research; focus on empirical tools and programming is highly welcome

• a Finance background is also welcome

Applications should include a resume, at least two letters of recommendation, and at least one recent research paper. Interviews of short-listed candidates will happen in January-February. The review of applications will continue until the position is filled.

Applications should be sent to energyecolab@gmail.com with the subject POST DOC.

Further details are available upon request from the Principal Investigator, Natalia Fabra (natalia.fabra@uc3m.es).

We are Hiring! Vacancy for Full-Time Research Assistant

We invite applications for a 1-year full-time Research Assistant position (Pre-doc).

Candidates should have a strong interest in research in applied microeconomics. The work would relate to several research projects in the areas of Energy and Environmental Economics and Industrial Organization

carried out at EnergyEcoLab (https://energyecolab.uc3m.es/).

The position will be based at the Economics Department of UC3M, one of the leading economics departments in Europe. The campus is located in Getafe (Madrid, Spain).

Roles and responsibilities:

– Obtaining and preparing datasets

– Conducting statistical and econometric analysis

– Preparing literature reviews

– Assisting members of the research team in other aspects of the project

Desired qualifications and experience:

Bachelor’s or Master’s degree in economics, mathematics, statistics, or related fields. Candidates about to obtain one of these degrees are also eligible. Ideally, candidates should have the intention to work towards a PhD in one of the above disciplines.

– Excellent management and organizational skills. Meticulous, organized, and detail-oriented.

– Strong quantitative skills. Excellent knowledge of Stata or R. Knowledge of Python, web scraping, and text analysis would be an advantage.

– Flexible, self-motivating, independent, and able to manage multiple tasks efficiently.

– Proficient in English.

– Strong interests in academic research.

– Able to legally work in the European Union.

Job conditions:

– Full-time position.

– The job will be based at UC3M in Madrid/Getafe.

– Duration: 1-year: September 1st 2023 to September 1st 2024. With the possibility of being extended for a second year.

– Salary: 1500€/month, gross salary.

Candidates should apply via email to energyecolab@gmail.com before June 1, 2023. Candidates should submit a curriculum vitae; a short statement of purpose describing reasons for interest in this position and future career plans; contact details of two recommenders (recommendations will only be solicited for finalists); transcript from Bachelor’s or Master’s; and a writing sample (undergraduate or Master’s thesis) if available.

Interviews will be conducted remotely around June, 2023.

Crisis Energética y ODS: ¿Una oportunidad?

El ayuntamiento de Barcelona organizó las II Jornadas de la Agenda 2030 el pasado 29 y 30 de noviembre, fueron dos días de encuentro plenamente presencial, pensados para generar intercambio, pensamiento y energía transformadora. Ante un escenario tan complicado, se preguntaron cómo los ODS (objetivos de desarrollo sostenible) pueden influir positivamente en la gobernanza de las ciudades, impulsando el cambio y rindiendo cuentas del trabajo realizado. También se vio cómo se está haciendo esto, en Barcelona y en otros lugares, y cómo coordinar mejor la acción por los ODS que se realiza desde las diversas administraciones.

Natalia Fabra participó en el segundo día, que estuvo dedicado a uno de los factores más críticos para el desarrollo sostenible: la energía. La transición hacia formas de energía que no generen emisiones de gases de efecto invernadero es una necesidad imperiosa, que es necesario hacer compatible con la salud económica y el bienestar social. Hablamos de un reto extremadamente complejo, para el que necesitamos un compromiso político fuerte y transversal, pero también una gran flexibilidad en los métodos, con capacidad de aprender rápidamente de todas las experiencias de éxito.

Puedes ver la presentación aquí.

Más información aquí.