Estelle Cantillon’s Keynote Lecture on Emissions Markets

Emissions markets are one of the leading policy instruments to fight climate change. In theory, competitive emissions markets allow to minimize the costs of compliance. What does the empirical evidence tells us?

Estelle Cantillon (Professor at the Economics Department of the Université Libre de Bruxelles) gave the concluding keynote lecture at the Simposio of the Spanish Economic Society that took place at Universidad Carlos III de Madrid. Its title was as inspiring as its content: “Emissions markets: What can they achieve in theory and in practice?”

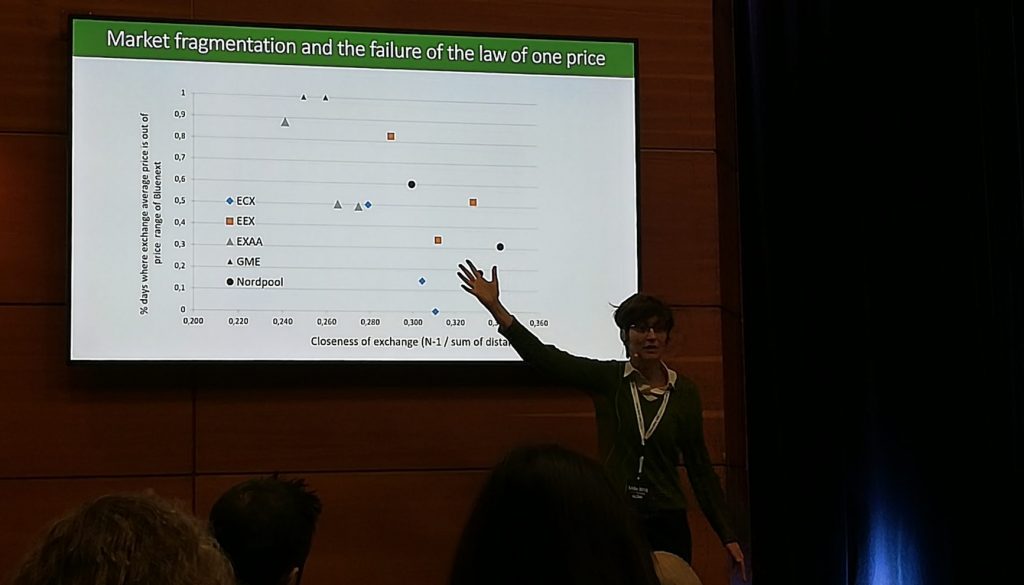

Estelle highlighted that emissions markets may fail to fully aggregate information when there exists private information about both emissions and abatement costs. Yet, the ability of prices to efficiently aggregate information is key for them to deliver efficient signals for investment and production decisions. Estelle went through the various underlying reasons for such a market failure. First and foremost, supply and demand in the emissions market are largely influenced by political decisions, as these affect e.g. the level of the cap and the number of allowances in circulation, among others. Additionally, information aggregation highly depends on the extent of participation, the existence of market fragmentation, and the nature of the risk management constraints that market agents face. Nevertheless, it is possible to avoid some of the frictions which prevent emissions markets from fully delivering full efficiency- she argued. As Estelle highlighted, there is scope to improve the performance of emissions markets through better market design.