We are delighted to share three forthcoming publications that deal with energy issues in the context of the pandemic. This research deepens our understanding of the mechanisms through which lockdowns and movement restrictions affect energy consumption and associated carbon emissions. It further investigates the links between energy demand and economic activity (as measured by GDP, for example). And it discusses the lessons that electricity markets can provide to cope with security of supply issues such as the ones that arise during major shocks such as the pandemic. Our papers have been accepted at the European Economic Review, The Energy Journal, and Energy Policy.

Natalia Fabra, Aitor Lacuesta and Mateus Souza investigate “The implicit cost of carbon abatement during the COVID-19 pandemic” in an article published this month at the European Economic Review. The first step of the analysis was to predict what the (counterfactual) electricity demand in Spain would have been in case the COVID-19 pandemic had not happened. We employ highly flexible machine learning algorithms for this task, in order to obtain accurate hourly-level predictions. These predictions then serve as inputs for a power sector model which allows us to understand which power plants would have been dispatched in the counterfactual scenario. By comparing plants dispatched under realized and counterfactual electricity demand, we calculate that the carbon abatement attributable to the pandemic ranged between 3.9 and 4.1 Million Tons of CO2.

For carbon reductions in other sectors of the economy, we use data from the Carbon Monitor. Summing all sectors, we estimate that total carbon abatement in Spain reached 23 Million Tons of CO2 during 2020. However, this came at a great cost, even if we do not consider the health damages and human loss due to the pandemic. Using projections from the Bank of Spain, we find that the Spanish GDP loss in 2020 was 169.37 Billion Euros. Comparing this figure to the emissions avoided results in an implicit cost of carbon of 7319 Euro/Ton. We conclude the paper with simulations showing that the abatement observed in the power sector could have been achieved at a much lower cost by investing in renewables. For that case, the implicit cost would range between 60-65 Euro/Ton of CO2.

Paper available here.

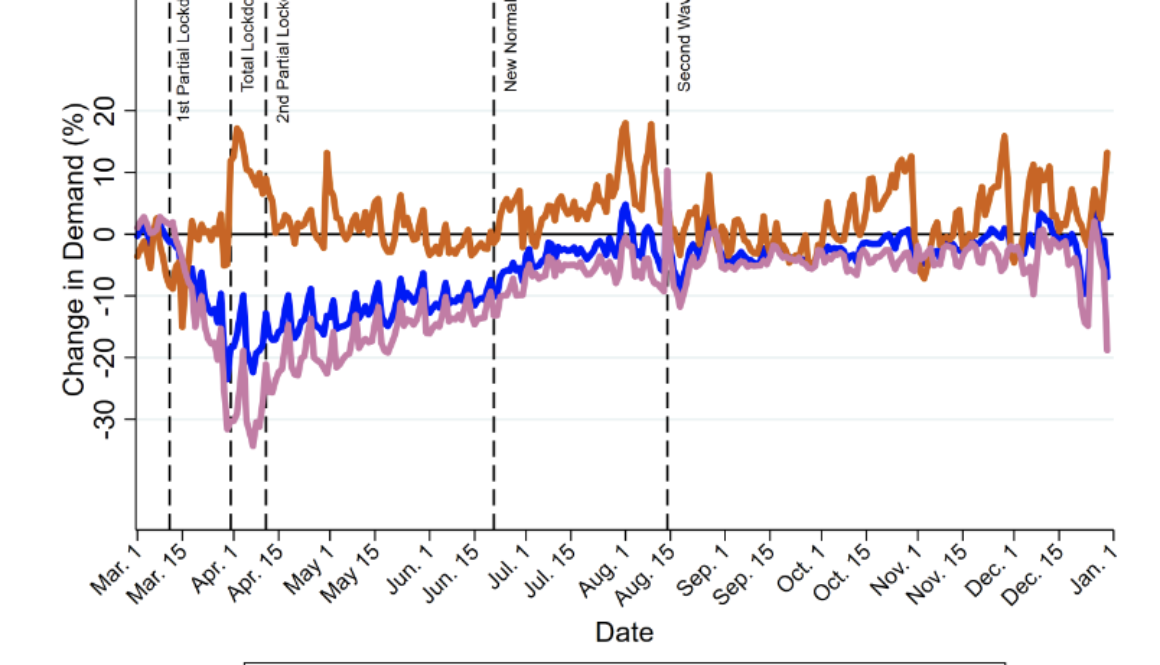

We provide more insight about the mechanisms through which Spanish electricity demand reduced during the pandemic in a paper forthcoming at The Energy Journal: “Firms and Households during the Pandemic: What do we learn from their electricity consumption?” This was a joint study by Natalia Fabra and a team of researchers from the Bank of Spain: Olympia Bover, Sandra García-Uribe, Aitor Lacuesta, and Roberto Ramos. The paper starts by laying out how Spanish grid-level electricity demand data can be decomposed into firms’ demand versus households’ demand. The first insight from this exercise is that households’ consumption increased due to lockdowns and movement restrictions, while firms’ consumption substantially decreased. Since firms represent a larger portion of the market, the net effect was of a strong decrease in demand. By plotting the demand figures against GDP growth rates, the authors arrive at another key insight: economic activity is better captured by firms’ electricity consumption, such that using total electricity consumption would under-estimate the severity of the economic impacts of the pandemic. Finally, the study provides evidence of substantial changes in the hourly patterns of electricity consumption, which differ across firms and households. For example, the pandemic was associated with large declines in electricity consumption by firms during working times, which are paralleled by simultaneous increases in households’ electricity consumption.

Paper available here.

In “Learning from Electricity Markets: How to Design a Resilience Strategy“, forthcoming at Energy Policy, Natalia Fabra, Massimo Motta and Martin Peitz argue that the economics of electricity capacity mechanisms provides valuable lessons for the provision of essential goods during crises, which need to be complemented with other elements aimed at mitigating their causes and impacts. The pandemic and post-pandemic times have demonstrated that preparing for global shocks requires the quick availability of some essential goods and services, including energy. Private incentives are typically insufficient for an economy to be prepared for rare events with large negative impacts. Instead, they argue that governments and preferably supranational institutions should implement mechanisms that make sure that prevention, detection and mitigation measures are taken.

Paper available here.