Renewable Energy and Storage Technologies: Complements or Substitutes?

David Andrés-Cerezo wrote this post on uc3nomics Blog, based on research by David Andrés-Cerezo and Natalia Fabra.

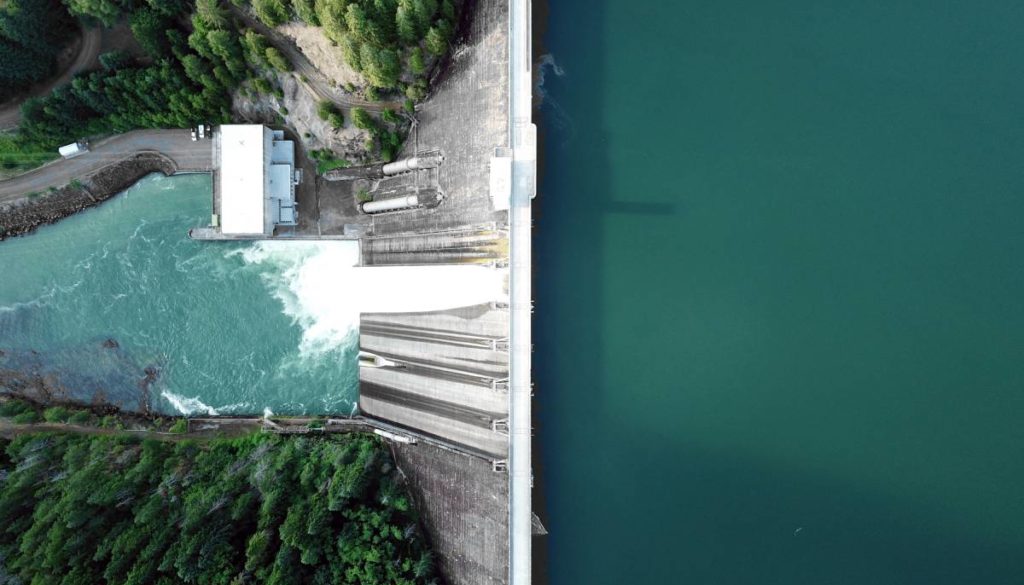

Renewable energy sources, such as solar and wind, are becoming increasingly popular to reduce our dependence on fossil fuels. However, these sources are also highly volatile, as their output fluctuates significantly across time and weather conditions: a solar farm cannot generate electricity after the sun sets, and a windmill does not run on calm days. Grid reliability requires that supply always meets demand, but the volatility of renewable energies makes it challenging. For this reason, energy systems worldwide seek solutions to shift supply from periods with abundant renewable energy to those when it is relatively scarce. This is where energy storage technologies come in. These technologies, including batteries, pumped hydro, and compressed air, are a remedy to counteract the variability of renewable energy sources. Moreover, their investment costs have sharply declined, making storage a potentially attractive option for promoting a quick and cost-effective energy transition.

Policy options and regulatory debate

How can renewable energies and storage technologies be encouraged? Is it enough to rely on market incentives, or are other support measures needed? The dramatic decline in the cost of renewable energy investments has promoted a rapid deployment of these technologies. In turn, the volatility of renewable energies will likely enlarge price arbitrage opportunities for firms looking to invest in storage. Finally, the availability of grid-scale storage will boost the value of renewable assets by reducing curtailment in periods when renewable production is large relative to demand. So, is that it?

This logic suggests that renewable energy and storage are complementary technologies, which reduces the need for further support. Still, regulators worldwide are implementing various policies to encourage investments in renewables and storage. For instance, the California Public Utility Commission has implemented a mandate requiring utilities to procure energy storage. Similarly, several European countries, such as Spain, are mandating battery investment as an eligibility requirement for renewable energy subsidies. Beyond the standard goal of correcting environmental externalities, these policy interventions may be motivated by coordination failures that prevent a quick transition to carbon-free power markets. But, are these policies equally effective at every stage of the energy transition? Should they be tailored to the characteristics of each market, such as their solar potential? How do policies to support one technology affect investment incentives for the other?

Modeling electricity markets with energy storage

In a recent article with Natalia Fabra, we seek to answer these questions by modeling investment and operation decisions in wholesale electricity markets. We then quantify the theoretical predictions with simulations of the Spanish electricity market under two scenarios with low and high renewables penetration and different levels of storage capacity.

In our theoretical model, competitive storage and generation firms first decide whether to enter the market and then choose how much to produce and store/release in each hour of each day. Storage operators benefit from arbitraging price differences over time: they buy (charge their batteries) when prices are low and sell (discharge their batteries) when prices are high. The availability of renewable energy affects their profitability as renewables generation might depress prices when the storage facilities charge (in this case, the profitability of storage goes up) or when they discharge (its profitability goes down). Likewise, storage affects the profitability of renewables positively or negatively depending on whether storage operators charge their batteries (which increases prices) or discharge them (which reduces prices) when more renewables are available.

How do we know whether renewables make energy storage operators better or worse off, and vice-versa? Our model predicts that the correlation between renewable availability and market prices is key to explaining their relationship. A negative (positive) correlation means that renewables tend to be available when prices are low (high), which is when storage charges (discharges), thus pushing up (down) the prices at which renewables sell their output, increasing (decreasing) their profitability. Similarly, if this correlation is negative (positive), deploying renewable capacity depresses prices when storage charges (discharges), thus increasing (decreasing) the profitability of storage.

When should we then expect this key correlation to be positive or negative? Electricity prices depend on consumption patterns and solar and wind availability patterns, which vary across markets. Hence, the sign of the correlation between prices and renewables is an empirical question. For this reason, we explore the interaction between renewables and storage in a given context: the Spanish electricity market.

Simulating the Spanish wholesale electricity market

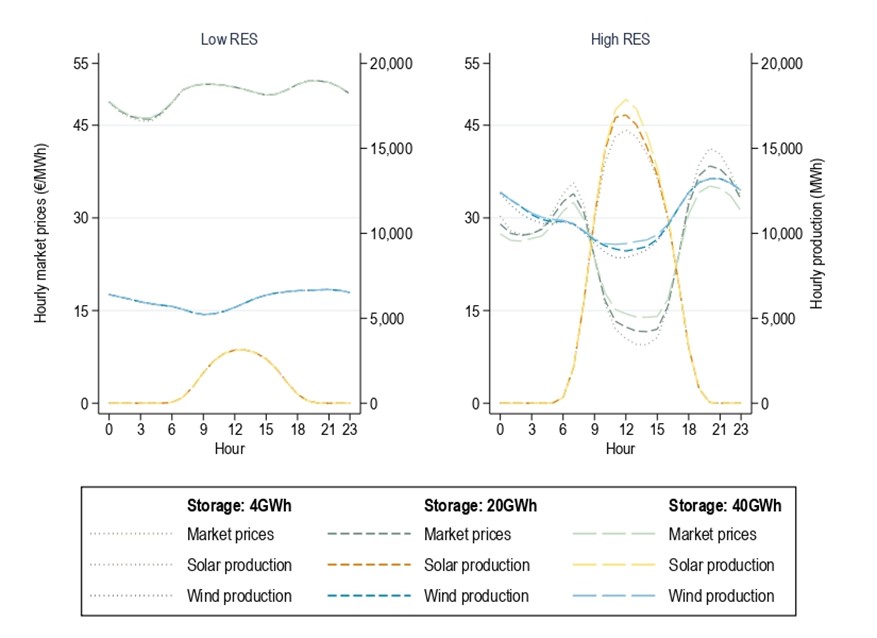

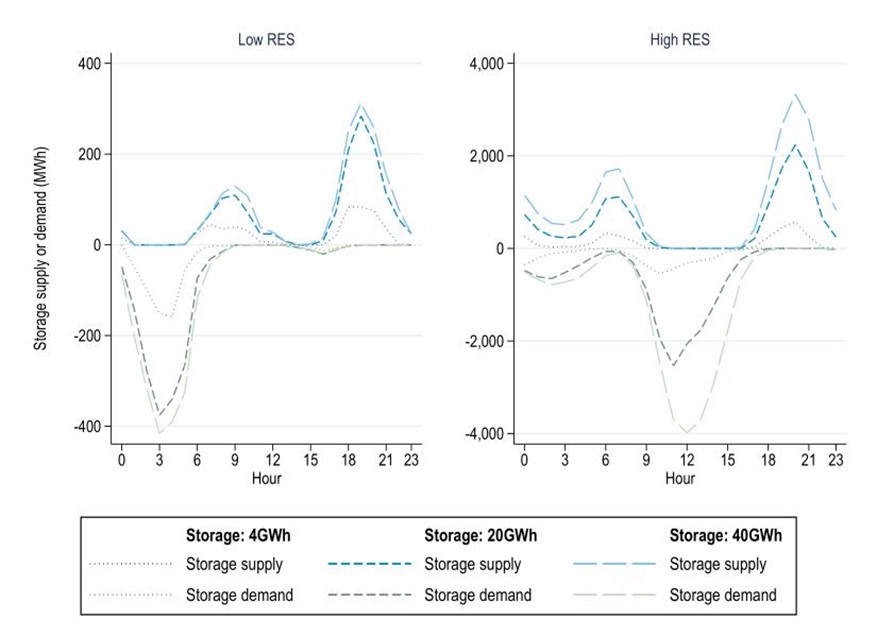

We consider two scenarios: the Spanish electricity market as of 2019, when renewable penetration was relatively low (8.7 GW of solar and 25.6 GW of wind), and the market as it is expected by 2030, when solar and wind capacities are planned to reach 38.4 GW and 48.5 GW, respectively. For each scenario, we consider various levels of storage capacity from 4 GWh to 40 GWh. Figure 1 shows wind and solar production and electricity prices over an average day in 2019 (left panel) and 2030 (right panel). Figure 2 displays (average) hourly storage and release decisions in these two scenarios.

Figure 1: Prices and renewable generation over the day

Figure 2: Charging and discharging decisions over the day

Let us focus on solar production. Figure 1 shows that solar production is concentrated in the intermediate hours of the day. This implies that solar is positively correlated with prices when there are few solar farms (left panel), as solar peaks at noon when consumers’ demand is high. When solar production becomes abundant (right panel), the correlation between prices and solar production becomes strongly negative, as solar generation depresses market prices when available. As a result of this price impact, storage firms shift from charging during nighttime when solar penetration is low (left panel) to charging in the midday hours when solar generation is abundant (right panel).

What does this behavior imply for the profitability of solar plants and storage firms in the Spanish electricity market? At the early stages of the renewable deployment (left panel), entry by an additional solar farm has a negligible impact on storage profits, as the price at which storage charges during the night remains unchanged and solar production does not affect the prices at which storage firms sell their output. Similarly, adding storage capacity has no price impacts at times of solar availability. Hence, the profitability of solar and storage investments remains independent despite the positive correlation between prices and renewables.

However, a big expansion in solar capacity has two effects: it enlarges price differences across the day and makes the correlation between prices and solar production turn negative. As a result, battery utilization increases, and storage profits climb sharply. Similarly, increasing storage capacity from 4 GWh to 40 GWh substantially increases prices in midday hours when storage firms are filling their batteries. Since this coincides with the periods in which solar farms produce energy, their profits go up. This is further compounded by storage allowing more efficient use of solar assets since it reduces energy spills in periods of abundant solar production.

Policy implications

In sum, whether renewables and storage complement or substitute each other might vary from one market to another and differ across time. Policies to promote these technologies should evolve accordingly. In the early stages of solar capacity adoption, prices are typically positively correlated with solar production. Since solar generation is not abundant, it has no price impacts, and the profitability of storage remains independent of how much solar capacity there is. At later stages of the Energy Transition, solar generation depresses prices, turning the correlation between solar generation and prices negative. This implies that increasing storage makes solar firms better off, and increasing solar capacity makes storage firms better off, i.e., they become complements once the correlation is reversed.

Therefore, our findings suggest that a big initial push for renewable investment is necessary to trigger the complementarity between renewable energy and storage. Once the negative correlation kicks in, policies aimed at promoting one technology would come with the additional benefit of promoting the other, shifting the market to a more decarbonized long-run equilibrium.

But this does not set the question once and for all! Future electricity markets may have very different demand and supply patterns from those of today. Therefore, policy design should pay close attention to the specific characteristics of each market at different stages of the energy transition and evolve with it.

Further Reading:

Andrés-Cerezo, and D. Fabra, N. (2023) “Storage and Renewable Energy: Complements or Substitutes?”, Working paper.

About the authors:

David Andrés-Cerezo is Visiting Professor Carlos III University and EnergyEcoLab. He is interested in Energy and Environmental Economics, and Political Economy.

https://sites.google.com/view/davidandrescerezo/main

Natalia Fabra is an industrial economist working in the field of Energy and Environmental Economics. She is Professor of Economics at Carlos III University.